Understanding the U.S. customs entry process is crucial to avoid delays, penalties, or the rejection of a shipment. The import of chemicals is highly regulated in the United States due to the environmental and health risks associated with chemical substances. For chemical companies related to chemical imports, adherence to the Customs and Border Protection is important for timely delivery and uninterrupted business operations.

To import chemicals into the United States, importers are required to file an entry with CBP. This filing is essential for ensuring that imported chemicals comply with local law, safety protocols, U.S. import laws, and regulations enforced by relevant federal agencies.

Additionally, customs officers may request information such as the country of origin, product type, HS code, cargo weight, and freight cost. These details are used to calculate the customs duties applicable to the imported shipment. Ensuring proper documentation, selecting the correct entry type, complying with partner agency regulations (like FDA, EPA, and DOT), and using the ACE portal and custom bonds are critical steps in the process.

By understanding and following the step-by-step entry procedure, chemical importers can significantly reduce risks, ensure compliance with CBP and federal agency requirements, and make their import process smoother and more efficient.

- Understanding the Basics of Customs Entry

- Types of Entry in Customs

- Certificate of origin

- Documentation Required for Customs Entry of Chemicals into the U.S.

- Understanding the ACE (Automated Commercial Environment) System Navigation & its role in the customs clearance process

- What Are Customs Bonds, and Their Role in the Import Process?

- Chemical Import custom clearance process

- Applicable charges for U.S. customs clearance

- Common Mistakes to Avoid

- FAQs

Understanding the Basics of Customs Entry

What is a Customs Entry?

A customs entry is a formal declaration submitted to customs authorities for chemicals being imported into the country. In the United States, it is also known as an entry summary or Form 7501. This document includes detailed information about the shipment, such as the description of the chemical, quantity, country of origin, customs classification number, and estimated duties and taxes.

Who is Responsible for Filing?

The responsibility for filing a customs entry typically falls on the importer of record (IOR). IOR may be the owner of the shipment, the purchaser, or a designated representative, like a customs broker. To proceed with the entry filing, the IOR must hold a valid IRS Employer Identification Number (EIN) or obtain an Importer ID Number from U.S. Customs and Border Protection (CBP).

Importer of record (IOR)

The owner or buyer of the imported chemicals must be a legally recognized entity in the country receiving the shipments. The IOR is responsible for the import process, paying the applicable duties and taxes related to the chemical.

Customs Broker

A licensed professional or firm authorized by U.S. Customs and Border Protection (CBP) to help importers and exporters in managing the customs clearance process. The requirements for customs brokers are defined in Title 19, Part 111 of the Code of Federal Regulations (19 CFR 111).

A customs broker acts as a link between importers and government authorities. They handle the filing of import documents, ensure compliance with federal regulations, arrange transshipment, and coordinate with relevant agencies to help move shipments through customs without delays. They ensure the shipment complies with local law, tariffs, and taxes.

Key Functions of a Customs Broker

- Preparing and Filing Entry Documents

- Chemical Classification

- Freight coordination

- Calculating the Duties and Fees

- Custom Bond and Specialized Handling

- Arranging the Bond requirements

- Managing the shipment release and delivery

Difference between Importer of Record (IOR) and Customs Broker

| Aspects | Importer of Record (IOR) | Customs Broker |

|---|---|---|

| Role | Legally responsible for the imported chemicals | Assists with customer clearance on behalf of the importer |

| Responsibility | Ensures compliance with all import laws and pays duties | Prepares and files paperwork with the U.S. Customs (CBP) |

| Legal Authorities | Must be named on the customs entry | Must be licensed by CBP |

| Engagement with Authorities | Direct dealing with customs officials, handling, and documentation | Assist in communication between the IOR and customs authorities |

| Examples | Can be the owner, purchaser, or consignee of the product | Can be an individual or a firm providing brokerage services |

| Obligations | Maintains records, ensures accurate declarations, and pays fees | Classify Product, estimate duties, and arrange clearance |

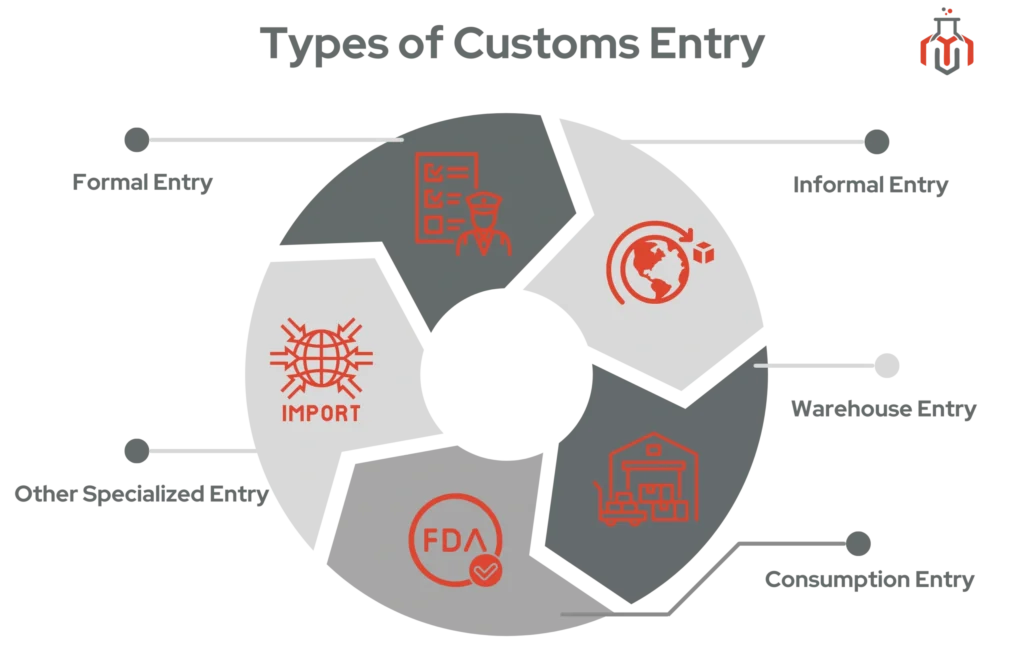

Types of Entry in Customs

The type of customs entry of chemicals depends on their classification, nature, and value. Understanding these types is essential for importers to ensure compliance and efficient clearance. Only the owner, purchaser, or a licensed customs broker can file a customs entry for chemicals. Once the shipment is presented for entry, it will be examined by authorized bodies.

- Formal entry – A formal entry is required in the process of importing goods that exceed a value of $ 2,500 or are subject to specific regulations. It requires detailed documentation with a bill of lading, air, road, and ocean freight, or other import-related documents.

- Informal entry – Primarily for shipments valued under USD 2,500, often for small commercial transactions. It requires only simpler documentation, such as a commercial invoice and an airway bill.

- Warehouse entry – This entry allows imported goods to be stored in a bonded warehouse without immediate duty payment. It offers a strategic way to manage inventory, reduce upfront costs, and stay compliant with regulations.

- Consumption Entry – A common type of entry for products that are imported and directly going into the United States market without any restriction. It is mostly for FDA-regulated products.

- Other Entry Types – Other types of entry include Immediate Transportation to move from the port of arrival to another port without duty payment, Transportation & Exportation( T & E) for export without entering U.S. commerce, Temporary importation under Bond for the product which is re-exported within a time limit, and Foreign Trade Zone entry for chemical which admitted into an FTZ without formal customs entry.

Certificate of origin

A certificate of origin, also called COO, C/O, or CO, is an official document that certifies the country in which the chemical is manufactured. It is required to check proof of origin and determine eligibility for preferential tariff treatment. CO depends on various factors, such as where the product is manufactured or assembled.

Types of Certificates of Origin

- Non-Preferential Certificate of Origin – This certificate is issued for the product to certify the origin for trade purposes without any preferential benefits. It is a general requirement for customs clearance and adherence with the import regulations.

- Preferential Certificate of Origin – This certificate is issued when chemicals are traded under a Free Trade Agreement (FTA) or other preferential trade arrangements that provide for reduced or eliminated import duties. It helps importers receive reduced or zero duties, making trade more cost-effective.

Documentation Required for Customs Entry of Chemicals into the U.S.

Proper documentation is essential before initiating customs entry for chemical imports to avoid last-minute hurdles and unnecessary delays. It is crucial to comply with the requirements of CBP and other federal agencies such as the EPA, FDA, and DOT. Having a well-prepared and compliant set of documents not only speeds up customs clearance but also reduces the risk of shipment holds and penalties.

Documents typically required for customs clearance are –

- Commercial Invoice – Includes buyer and seller details, full product description (chemical name, formula, concentration, CAS number).

- Bill of Lading (B/L) or Air Waybill (AWB) – Used for ocean or inland shipment, issued by the carrier.

- Safety Data Sheet (SDS) – Required for hazardous materials (HAZMAT) and chemicals.

- HTS classification & Chemical Tariff codes – Each chemical must be properly classified under the HTSUS.

- TSCA certification – Required for all chemicals imported into the United States, regulated by the EPA.

- Packing list – It contains the information about the number of containers, boxes, drums, or pallets, Net weight, and dimensions of each package.

- Country of Origin certificate (COO) – It certifies the country where the chemical was manufactured.

- Letter of Authorization (LOA) – Grants a U.S. customs broker the authority to act on behalf of the importer during the entry process.

- Importer Security Filing (ISF) – Requires importers and carriers to provide cargo information for ocean shipments, also known as the 10+2 rule.

- Custom Entry Summary (CBP form 3461) – Entry form used for the request to release imported chemicals into the U.S

- Custom Entry Summary (CBP form 7501) – It is the final summary for duty payment and import record.

- Arrival Notice – Used to notify the consignee about the arrival of the shipment.

Want to ensure full compliance when importing hazardous materials?

Read our detailed guide: Regulations for Importing Hazardous Materials into the U.S.

Understanding the ACE (Automated Commercial Environment) System Navigation & its role in the customs clearance process

ACE is the electronic single window platform for all trade processing, including all import and export data. It allows importers, customs brokers, and Partner Government Agencies (PGAs) to submit required documentation electronically. It can be accessed through two channels –

- ACE Portal – A free, web-based access point designed to connect CBP, trade partners, and partner government agencies (PGA).

- ACE Electronic Data Interchange (EDI) – A communication framework that provides standards for exchanging data via electronic means.

What Are Customs Bonds, and Their Role in the Import Process?

A customs bond is a financial guarantee between the CBP, a bond surety company, and an importer. It expedites clearance by ensuring immediate payment of duties, taxes, and fees, if required. This allows the CBP to clear the shipment without waiting for the importer to clear the fees. It is immediately paid by the surety company on behalf of the importer, which is later paid by the Importer company.

Types of Bonds –

- Single-Entry Bond– It is mainly for individual shipments. For one-time or low-frequency imports.

- Continuous Bond – A continuous bond is a customs bond that will cover all imported shipments for one year from the date of issue. Covers multiple shipments over a year – ideal for regular chemical importers.

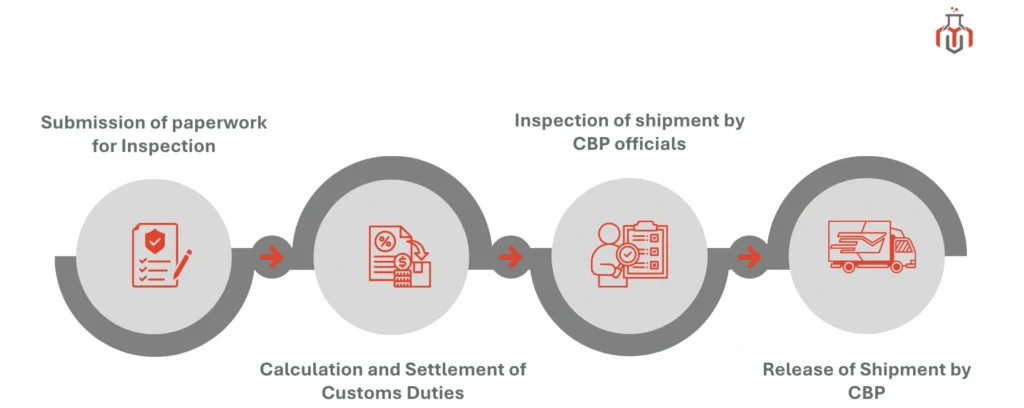

Chemical Import custom clearance process

- Submission of paperwork for Inspection – The first step in the customs clearance process begins when the importer or their customs broker submits the required shipping documents, such as the commercial invoice, packing list, and bill of lading, and associated documentation to CBP via the ACE portal. This filing is known as the port entry.

- Calculation and Settlement of Customs Duties – Once the documentation is submitted, the calculation of duties and taxes is analyzed based on the type of chemical, volume, its country of origin, and trade agreements. In this authority check, all the duties, taxes, or fees, and if payment is required, it must be completed within 15 days to avoid penalties.

- Inspection of shipment by CBP officials – Once payment is completed, it goes for inspection, where it may undergo a random inspection or a targeted review based on risk assessments.

- Release of Shipment by CBP – Once all inspection criteria are validated and supporting documents are reviewed, CBP releases the shipment.

Applicable charges for U.S. customs clearance

To legally import chemicals into the United States, importers must comply with U.S. customs regulations and submit complete and accurate documentation. The customs clearance process also involves several mandatory charges, which vary based on the type of product, shipment method, and regulatory requirements.

Charges applicable to U.S. customs clearance are –

- Customs duties (HTS-Based Tariffs) – Each chemical has a specific tariff code.

- Merchandise Processing Fee (MPF) – A fee paid to CBP as a service charge for processing and handling import entries at ports.

- Harbor Maintenance Fee (HMF) – A fee collected by the CBP to cover the maintenance of the U.S. ports and harbor infrastructure, applicable to ocean shipments.

- Excise Tax – Applied on the selected chemicals, based on quantity, value, or chemical class.

- Anti-Dumping Duties (ADD) – Imposed on chemicals from countries that dump products below market value or subsidize exports.

- Customs Bond Fees – A service charge paid to the customs broker or agent for managing the filing and clearance process.

- ISF filing charge – This applies only to the ocean freight shipments, sometimes combined with the customs clearance fees.

- Demurrage and detention – It is paid to the carrier by the importer if the shipment stays at the port for more than a specific time.

Want to avoid common mistakes in chemical warehousing?

Read our latest blog post: Handling and Storage of Chemicals | Guidelines for a US Distributor

Common Mistakes to Avoid

- Misclassification of HS codes – Misclassifying goods with the wrong HS code can lead to delays, additional charges, or legal issues.

- Misinterpretation of Incoterms® – It is essential to confirm and clearly define international commercial terms in trade agreements to clearly communicate the tasks, costs, and risks associated with global or international transportation.

- Incorrect Declaration of customs value – Carefully review and confirm all values before submission to avoid penalties.

- Ignoring partner government agency (PGA) flags – Importers and brokers use the ACE system to submit the required documents to government agencies.

- Errors in the country of origin declaration – Providing inaccurate descriptions or missing data leads to shipment delays.

- Incomplete or incorrect supporting documentation– Using correct documentation significantly enhances the customs clearance procedure.

- Using Incorrect EORI or VAT Numbers – Incorrect EORI and VAT numbers in international trade can lead to several complications, like trade disruptions, Financial penalties, and shipment delays.

FAQs

Q. How long does customs clearance take in the USA?

Customs clearance in the U.S typically takes 24 to 72 hours. However, in some cases, it may take several days or weeks, depending on the type of chemical, shipment volume, and the completeness of required documentation.

Q. How to check customs entry status?

Entry status can be checked through the CBP’s ACE (Automated Commercial Environment) portal or by contacting the freight forwarder and customs broker handling the shipment. Details required for this include entry summary, bill of lading number, and the filer code, along with other relevant shipment identifiers.

Q. What are the steps that must be done in customs?

For safe and timely clearance, it is advisable to thoroughly review CBP guidelines, ensure that all documents are accurate and complete, and file the customs entry through the ACE system with the U.S. Customs and Border Protection (CBP).

Q. What is the Bill of Entry in customs?

A Bill of Entry (BoE) is a legal document submitted by the importer or an authorized agent to facilitate the customs clearance process. It includes the details about the type, quantity, and value of imported chemicals.

Q. Does custom open your package?

Generally, CBP officials don’t open every package; most shipments are scanned electronically. However, CBP has the authority to inspect any package if there are red flags, such as suspicious contents or incomplete documents.

Q. What is not allowed in US customs?

CBP restricts or prohibits the entry of items like absinthe, rohypnol, certain agricultural products, endangered species, and goods that may harm the environment or national security.

Q. What happens when customs denies entry?

When a customs entry is denied, a Notice of Action may be issued to the importer. Depending upon the condition, customs may allow the resubmission of corrected documents. In other cases, the shipment may be returned to the country of origin, seized, or destroyed, particularly if it violates import regulations or contains prohibited items.

Macschem is the leading supplier of high-quality chemicals in the US.

Disclaimer:

This blog, “Customs Entry Process for Chemical Imports: Step-by-Step for New Importers,” is for general informational purposes only. It is based on publicly available sources and does not constitute legal, regulatory, or compliance advice. Readers should consult licensed customs brokers, regulatory experts, or relevant authorities to ensure adherence to applicable U.S. import laws and chemical import regulations.

Resources